When you think you can’t retire, retiring is retiring early” – Halisi of Our Black Utopia.

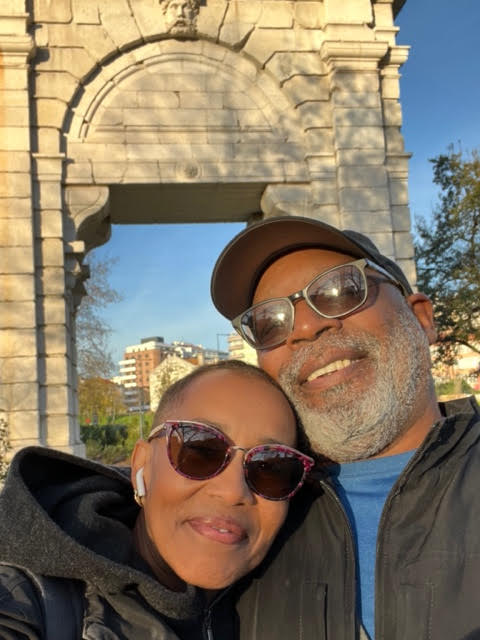

Halisi and Ric from Our Black Utopia are the kind of couple you want in your inner circle.

Yes, they’ve launched an education business, revamped a struggling non-profit, ran for public office, became Democratic National Delegates in 2012 and 2020, helped pass national and state laws, traveled to 15 countries on 3 continents, met the former first lady, Michelle Obama, worked on motion pictures, television shows, and toured the country opening for big-name stars like Prince.

Yet, they’re still the real and relatable couple that will drop as many gems on you as they do laughs. And I got to sit down with them to pull back the curtains on their course creation journey to find out how they retired ten years ahead of schedule, grew their net worth to $1 million and now live in the sunny paradise of Portugal.

They’ve been on the Thinkific platform since May 2022, starting on the free version. They’re also members of the Thinkific Accelerator, where they launched their course, Beyond the Bling and reaped their initial investment back in the first week of sales. So I had to get them on a call to share their origin story, challenges and how others can replicate their success (and selfishly, I wanted to know how I could live abroad too).

Tennile: So, let’s dive into your origin story. I’m really curious to understand what got you interested in financial freedom and helping Black folks to retire early. I can say that you’re helping Black folks, right? I get that from the name, Our Black Utopia.

Ric: Well, we help anybody, but we’re more concentrated on Black folks.

Halisi: Yes. It depends on which course we’re talking about too, but our target audience is Black folks aged 45 to 65. You know, we don’t have the history of understanding how money works like our parents.

Six and a half years ago, we met with a “Financial Advisor” who really was an insurance salesman. And Ric walked away from that, so depressed because the financial advisor had laid out what our “future” would look like, and we weren’t doing great. But when you think about the average American, they’re $400 away from a financial catastrophe.

And back then, we had about $35,000 saved between retirement and savings accounts. Our bills were paid. And we paid them on time.

Ric: Don’t forget, we had decent credit.

Halisi: Right! And I was being overly optimistic, and I was like, “They don’t know how much money we’re going to make in the future, and that’s based on what we make now.” But I realized it didn’t matter what we made in the future if we continued spending the way we were. And that was the wake-up call.

How it began

This led them to start looking at their budget and tracking their expenses, which revealed that they were spending $900 to $1,000 a month eating out. They then got strict with their budget, decided on an allowance for themselves, and worked on paying off their debt.

Which launched their journey to get out of debt and retire early. They began saving 60% of their income during the pandemic and discovered the FIRE (Financial Independence, Retire Early) movement. Their discovery allowed them to retire at 57 rather than the previously anticipated age of 67.

Tennile: What made you want to start creating a course? How did that come about?

Halisi: We were asked. Actually, we started a YouTube Channel first. We made this decision during the pandemic and launched our first course in May 2022 with three students.

But honestly, we wanted out of the workforce. I was working 70 hrs a week and taking care of my dad at the same time. I started watching how other YouTubers built a business and was like, no, I can’t do this for another two years. I will die. My hair was falling out, and I was losing weight rapidly. I just couldn’t do it anymore. And we were like, okay, so we’re not going to retire 3 or 4 years from now we’re going to retire ASAP.

Building an audience

Halisi and Ric started a YouTube channel (that now hosts 19.6k subscribers) to document their journey and retired early from their jobs in politics and non-profit. They changed all their online profiles to be branded under their channel name. They participated in live chats and Facebook groups to find their audience and built collaborations with bigger YouTubers to gain more visibility. Additionally, they forgave themselves when they made mistakes because the more important thing for them was to be authentic and genuine.

Tennile: So you had an audience way before you started a course which is great. Many people don’t usually start that way, and we advise that they do. How did you initially build it?

Halisi: We had an email list from our previous profession.

Tennile: Smart. You tapped into your network.

Halisi: Yeah, because people will start something and then don’t want to tell anybody. We told anybody who would listen—friends, family and fools. I’m not hiding this because if you like me, then you might want to follow what we’re up to.

Tennile: Yup. That’s branding

Halisi: People are afraid to practice in public, and some of our stuff was so embarrassing from those early days. But there are people that are so forgiving when you’re still just figuring it out, and if you are genuine and authentic, they appreciate that.

Ric: It shows your vulnerabilities. And they were very forgiving, and they came back and kept coming back.

Halisi: There was a professor who followed our journey on YouTube, and they ended up being one of our first clients.

Our Black Utopia evolved its course and pricing in the figuring out stage of when they first launched and believed it was priced too high. When they re-launched the second time, they purchased Thinkific under a 3-month promotion that included on-demand training and live office hours. They gained about 60 students and priced their audio course lower, and it ran for one week with daily Q&A lives.

From this, they got a lot of testimonies and feedback on improving their course, resulting in the third iteration with video lessons and $4k worth of sales in under a month.

And, of course, we discussed their life in Lisbon, Portugal, compared to the costs of living in America. They can live comfortably on €2,600 a month, which covers expenses like a bigger apartment, healthcare, housekeeping, dining out, and they don’t need a car since transportation is affordable.

Halisi and Ric originally intended to create content for their children and the couples in their social circle, then found their audience expanding beyond their initial demographic. Their goal was not only to make money, but to share their knowledge and help others find the same financial freedom as they did.

Feeling inspired? Check out more creator stories here.

Want to join the same Accelerator program that Halisi and Ric participated in to create Our Black Utopia? Check that out here.